Does Owning A Home Really Help You Build Wealth?

- Charles "Skip" Geiser

- Jul 25, 2023

- 2 min read

You may have heard some people say it’s better to rent than buy a home right now. But, even today, there are lots of good reasons to become a homeowner. One of them is that owning a home is typically viewed as a good long-term investment that helps your net worth grow over time.

Homeownership Builds Wealth Regardless of Income Level

You may be surprised to learn homeowners across various income levels have a much higher net worth than renters who make the same amount. Data from First American helps illustrate this point (see graph below):

What makes wealth so much higher for homeowners? A recent article from Realtor.com says:

“Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity. And over time, equity can turn your mortgage debt into a sizeable asset.”

Basically, the wealth you accumulate when you own a home has a lot to do with equity. As a homeowner, equity is built up as you pay down your loan and as home prices appreciate over time. Mark Fleming, Chief Economist at First American, explains how this same benefit isn’t true for renters in a recent podcast:

“Renters as non-homeowners gain no wealth benefit as home prices rise. That wealth actually accrues to the landlord.”

Before you decide to sign another rental agreement, now is a good time to think about whether it would be better for you to buy a home instead. The best way to figure out what makes sense for you is to have a conversation with a real estate expert you trust. That professional can talk you through the benefits that come with owning to determine if that’s the right next step for you.

Bottom Line

If you're not sure whether to keep renting or to buy a home, know that owning a home, no matter how much money you make, can help build your wealth. Let's connect now to get started on the path to homeownership.

What is the Market Doing?

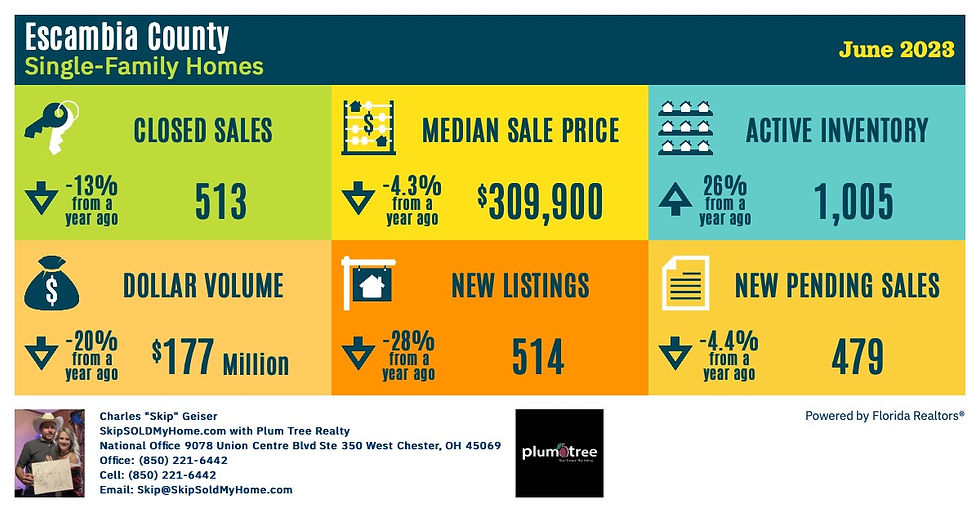

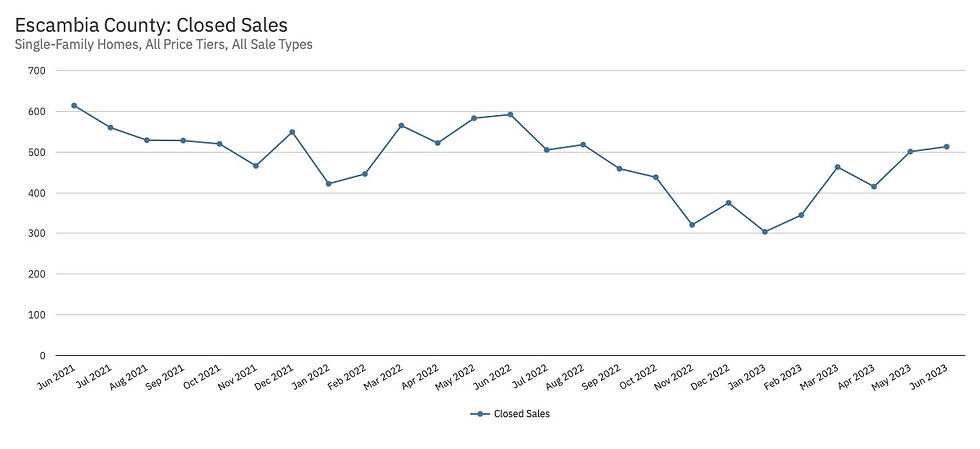

Escambia County

Escambia

Month | Closed Sales | % Change Year Over Year | |

June 2023 | 513 | -13.3 | |

May 2023 | 501 | -14.1 | |

April 2023 | 415 | -20.5 | |

March 2023 | 463 | -18.1 | |

Feb 2023 | 345 | -22.6 | |

Jan 2023 | 304 | -28.0 | |

Dec 2022 | 375 | -31.7 | |

Nov 2022 | 321 | -31.1% | |

Oct 2022 | 438 | -15.8% | |

Sep 2022 | 459 | -13.1 | |

Aug 2022 | 518 | -2.1% | |

Jul 2022 | 505 | -9.8% | |

Jun 2022 | 592 | -3.6% | |

May 2022 | 583 | 16.8% | |

Apr 2022 | 522 | 0.2% | |

Mar 2022 | 565 | 2.5% | |

Feb 2022 | 446 | 14.4% | |

Information from Florida Realtors

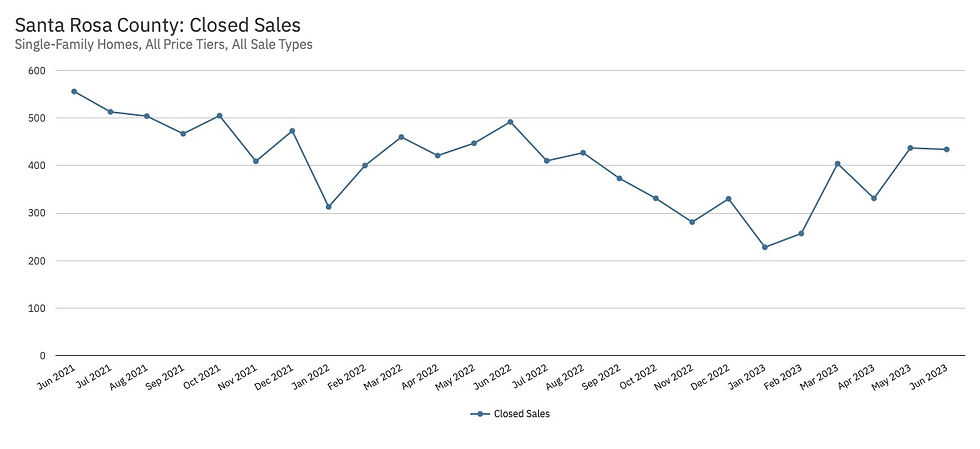

Santa Rosa County

Santa Rosa County

Month | Closed Sales | % Change Year Over Year |

June 2023 | 434 | -11.8 |

May 2023 | 437 | -2.2 |

April 2023 | 331 | -21.4 |

March 2023 | 404 | -12.2 |

Feb 2023 | 257 | -35.8 |

Jan 2023 | 228 | -27.2% |

Dec 2022 | 330 | -30.2% |

Nov 2022 | 281 | -31.3% |

Oct 2022 | 331 | -34.5% |

Sep 2022 | 373 | -20.1% |

Aug 2022 | 427 | -15.3% |

Jul 2022 | 410 | -20.1% |

Jun 2022 | 492 | -11.5% |

May 2022 | 447 | -4.1% |

Apr 2022 | 421 | -7.9% |

Mar 2022 | 460 | -0.4% |

Feb 2022 | 400 | 9.6% |

Information from Florida Realtors

Current Mortgage Rates

SkipSOLDMyHome.com with

Plum Tree Real Estate Marketing

850.221.6442

Start

Cary Schmidt's Introduction of Done

Gulf Coast Baptist Church Links

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Skip Geiser LLC. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Skip Geiser LLC. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Comments